There is a lot of focus today on the economy and how it should be repaired. Today’s economy is far more complex than that of the 1930s during our last depression and for that reason different tactics have to be employed. With this major recession, there has been a renewed focus on Keynesian economics, which countries like the United States and Great Britain have employed to reduce the sting of the faltering economy. There is a lot of debate as to whether monetarism, laissez- faire or Keynesian economics should be used to combat the “Great Recession”. As with many problems, usually the solution is a combination of varying ideas.

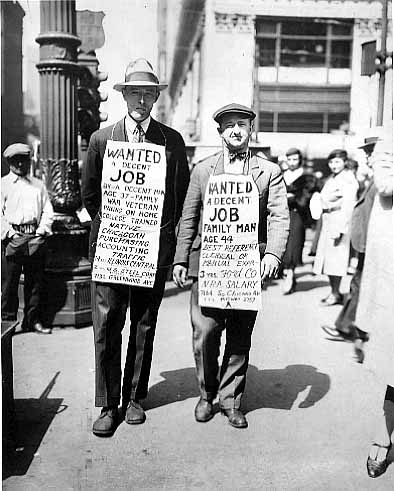

Keynesian economics argues for government intervention in the marketplace to reduce the pain recessions and depressions provide to a nation’s production, while people with a laissez-faire mindset believe the market will eventually correct itself without any government interference. I believe it is true that without any interference, eventually the economy would stabilize and grow again, but at what cost? If the economy becomes so unstable, it’s not hard to comprehend a country falling into chaos. Imagine if 30%, 40% or 50% of the nation became unemployed. There are plenty of current and former examples where a country’s economy has collapsed to devastating results. The problem with allowing this to happen in a developed country is how a developed country is comprised.

No longer do most people live in small rural villages, on large plats of land where one, if need be, could live off the land and depend on no one else. Americans, while living in rural locales, used to be well rounded and adapted to provide almost anything needed in a household, whether that was building new furniture, constructing a home or hunting and farming for a meal. Today’s American is no longer a generalist, but a specialist. We know how to do our one specific job, and often very well, but depend on other specialists to build our houses, construct our furniture and provide our food. Our society and economy has progressed so much in the last one hundred years that we no longer can fend for ourselves, because we either lack the skills, the means or both.

Due to this transition in our society, we can no longer afford a purely laissez-faire economic policy. If we allow it to collapse and the majority of Americans lose their job, how do they survive? Where do they grow their food? How do they build their shelter? Quite simply, they can’t. It’s imperative that the government intervene before such draconian results occur. Keynesian economics suggests that the government should become involved during economic downturns and cut back during economically strong years. Unfortunately, our politicians in Washington always forget to run a surplus and cut back, regardless of party affiliation. We either overspend in military or in domestic initiatives, creating a bigger hole for the government to fight future economic battles.

Unfortunately for Americans and citizens in other developed nations, economic warfare will be far more devastating than traditional warfare in the future and Americans are at a huge deficit disadvantage. Plenty of liberal politicians (and some so-called conservatives) believe that in order to promote the Keynesian model, deficit spending should be implored. This is absolutely incorrect. Deficit spending puts huge strains on a nation’s currency and inflation. While in the short run, it may stop the initial bleeding, it creates future troubles for years and even decades. Instead a nation’s government should curtail its spending and run a surplus in economic growth years. Taxes should not be continually cut to a balanced budget, because of the economic cycles, which vary in intensity based on the strength of the previous economic expansion. Instead, there should be a tax benchmark established for a “normal” economic year, which would create enough money to provide for essential government programs and save for the inevitable economic downturn or even collapse. In contrast, government should shrink during economically strong years, cutting unnecessary services established because of the recession.

Once a recession hits the economy, a government should spend, but only from a saved surplus, not deficit. This should help to keep government focused on only essential government spending and prevent pet projects or idealistic policy reforms. The government should also spend on activities that will promote private job growth (not public) and provide a social safety net for those individuals most impacted by the downturn in the economy. To effect this, government should reduce taxes by targeting business investment and expansion, so that they employ more people or lay off far less. Additionally, government should increase unemployment benefits and health benefits for a longer period of time for people actively seeking jobs, so that they can continue to pay essential bills. Today, many of the unemployment benefits are so low, that people cannot even make housing payments, causing excessive foreclosures only exasperating the economic pitfall. The combination of tax cuts and increased benefits for the downturn, paid for by the surplus, would simultaneously encourage fewer layoffs and economic expansion, keeping even unemployed purchasing goods and services thus dramatically reducing the severity and cost of a recession.

If the government used its surplus to pay for these items, it would avoid the inflationary spike and currency devaluation often accompanying deficit spending, meaning commodities and goods would not drastically increase in price. Once the economic downturn subsides, the government must gradually begin reinstating taxes (similar to interest rate increases by the Federal Reserve) and reduce unemployment benefits until we reach “normal” benchmark levels and a surplus is once again in effect. While this approach is not hands off, it prevents unnecessary government intervention and public works projects that waste more money than it provides jobs while softening the overall impact and duration of a recession.

No comments:

Post a Comment